|

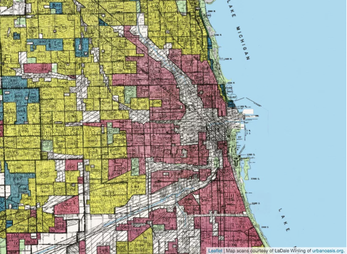

BY MORGAN MONTOYA, BEN STRICKLER, AND CLAIRE DAWSON “Redlining is a discriminatory practice that puts services (financial and otherwise) out of reach for residents of certain areas based on race or ethnicity.  What is Redlining? It can be seen in the systematic denial of mortgages, insurance, loans, and other financial services based on location (and that area’s history) rather than on an individual’s qualifications and creditworthiness (Kenton 2020).” But why does this matter? Because of the label of “bad investment areas”, banks and other financial institutions denied people who live in these areas service. Since these areas were redlined, banks were able to effectively stop the loan and cash flow to minorities with a justified cause. Because of biases in banks, residents in “redlined” areas will continue to be refused and this practice fuels the poverty cycle. Without these loans, minorities, in particular, were not able to start businesses, afford better homes, and just generally improve their economic conditions. History of Redlining How did it start? The idea of redlining started as a way to recuperate losses from the Great Depression, but it wasn't long before powerful bank owners found ways to exploit the market, forcing minorities into poverty. According to Linda Gartz, an award-winning writer for her works on redlining, “The HOLC [Home Owners Loan Corporation] hired local real estate agents to create color-coded maps of every metropolitan area of the country. Areas colored green were safest and red were riskiest. Even the most stable African American neighborhoods were ‘redlined’.” No matter what the true income of a neighborhood was, the maps were solely defined on the race of those living in the areas. Redlining in Chicago Chicago’s clear segregation within neighborhoods is the product of absurd redlining in minority communities. In the city, neighborhood lines clearly differentiate the income of those living there. The HOLC created the idea for redlining, and it took no time for people to realize they could use this idea to target minorities in Chicago. Ever since Chicago has been a heavy target for redlining. As a report from NBC says, “for every $1 banks lent in mostly white areas, banks lent 12 cents in mostly Black areas, like Englewood.” As Nikole Hannah-Jones says in her article “It’s Time for Reparations”, “from 1934 to 1962, 98% of the Federal Housing Administration Loans went to White Americans.” We have come to a point in our history where large corporations are not making an effort to cover up how disproportionately they are discriminating against minorities. However, in the absence of accountability, others are stepping up. As an article from the Encylopedia of Chicago says, “The Fair Housing Act of 1968 prohibited housing discrimination and the Home Mortgage Disclosure Act of 1975 required the release of data on bank lending.” This went nowhere near ending redlining in Chicago or any other places but it was a step in the right direction. Communities started banding together to put an end to redlining. Unsatisfied with what the Fair Housing Act accomplished, The Citizens Action Program (a non for profit created by people of the Chicago community) created the idea of greenlining. It encourages the people of Chicago to deposit savings in banks that had specific plans to give back to lower-income communities. This has proven effective and illustrates that Chicago can recover. The National Training Center has even been able to recover 173 million dollars in funds back to minority communities. Just as Chicago had been a pioneer in creating redlining, the city can hope to be an example of destroying it. Long-Term Impact The long-term impact redlining had on later generations of African Americans is undeniable. According to NPR, “Today African-American incomes on average are about 60 percent of average white incomes. But African-American wealth is about 5 percent of white wealth. Most middle-class families in this country gain their wealth from the equity they have in their homes. So this enormous difference between a 60 percent income ratio and a 5 percent wealth ratio is almost entirely attributable to federal housing policy implemented through the 20th century.” However, when this policy affected average wealth income, it also affected many other aspects of society. Lack of wealth connects to several other issues like lack of funding in schools, which leads to lower quality education, resulting in fewer job opportunities. When put into perspective, the issue of redlining is deeply systemic. Lack of wealth affects all parts of life for formerly redlined communities, and even years after the end of legal redlining, we will still see its effects until radical change takes place. Sources: Brooks, Marion. “Race in Chicago: The History of Redlining and How Race Has Shaped Our Lives.” NBC Chicago, NBC Chicago, 2 Sept. 2020, www.nbcchicago.com/news/local/race-in-chicago-the-history-of-redlining-and-how-race-has-shaped-our-lives/2330400/. Coates, Ta-Nehisi. “The Case for American History.” The Atlantic, Atlantic Media Company, 26 June 2014, www.theatlantic.com/business/archive/2014/06/the-case-for-american-history/371723/. Gartz, Linda. “What Is Redlining?: Redlining Resources: Chicago Author Linda Gartz.” Linda Gartz, 6 Jan. 2021, lindagartz.com/what-is-redlining/. Gross, Terry. “A 'Forgotten History' Of How The U.S. Government Segregated America.” NPR, NPR, 3 May 2017, www.npr.org/2017/05/03/526655831/a-forgotten-history-of-how-the-u-s-government-segregated-america. Kenton, Will. “Redlining.” Investopedia, Investopedia, 9 Dec. 2020, www.investopedia.com/terms/r/redlining.asp. Library, Newberry. Redlining, 2005, www.encyclopedia.chicagohistory.org/pages/1050.html. Wikipedia, n/a. “The Color of Law.” Wikipedia, Wikimedia Foundation, 11 Feb. 2021, en.wikipedia.org/wiki/The_Color_of_Law.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

RSS Feed

RSS Feed